THE PROBLEM

Customer Churn is Costing SMB's

Unreliable forecasting leaves manufacturers overstocked, tying up working capital, and incurring excessive holding and storage costs.

35%

Churn rate in the

manufacturing industry

40%

Churn rate in the

logistics industry

56%

Churn rate in the

wholesale industry

THE SOLUTION

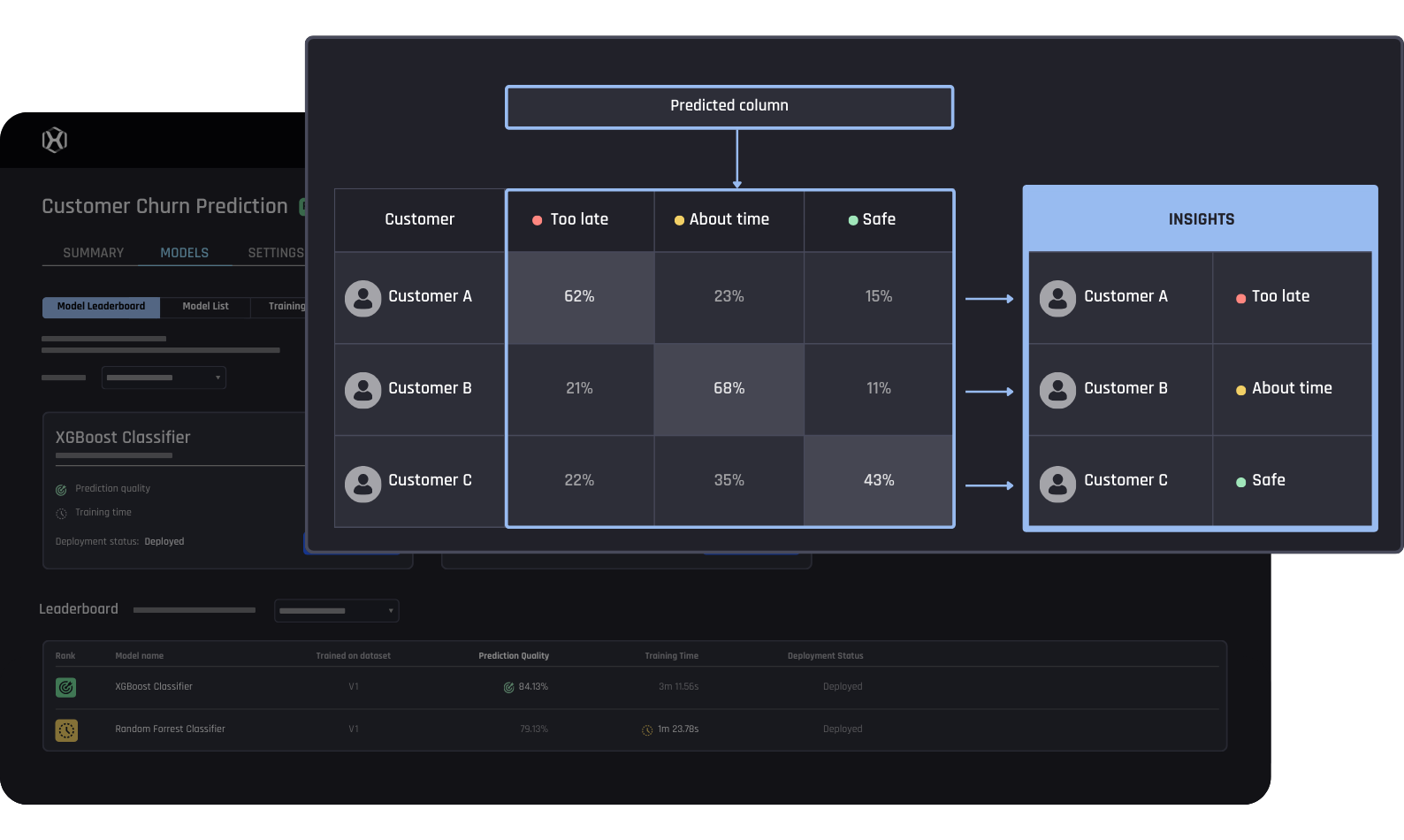

Individual Churn Predictions

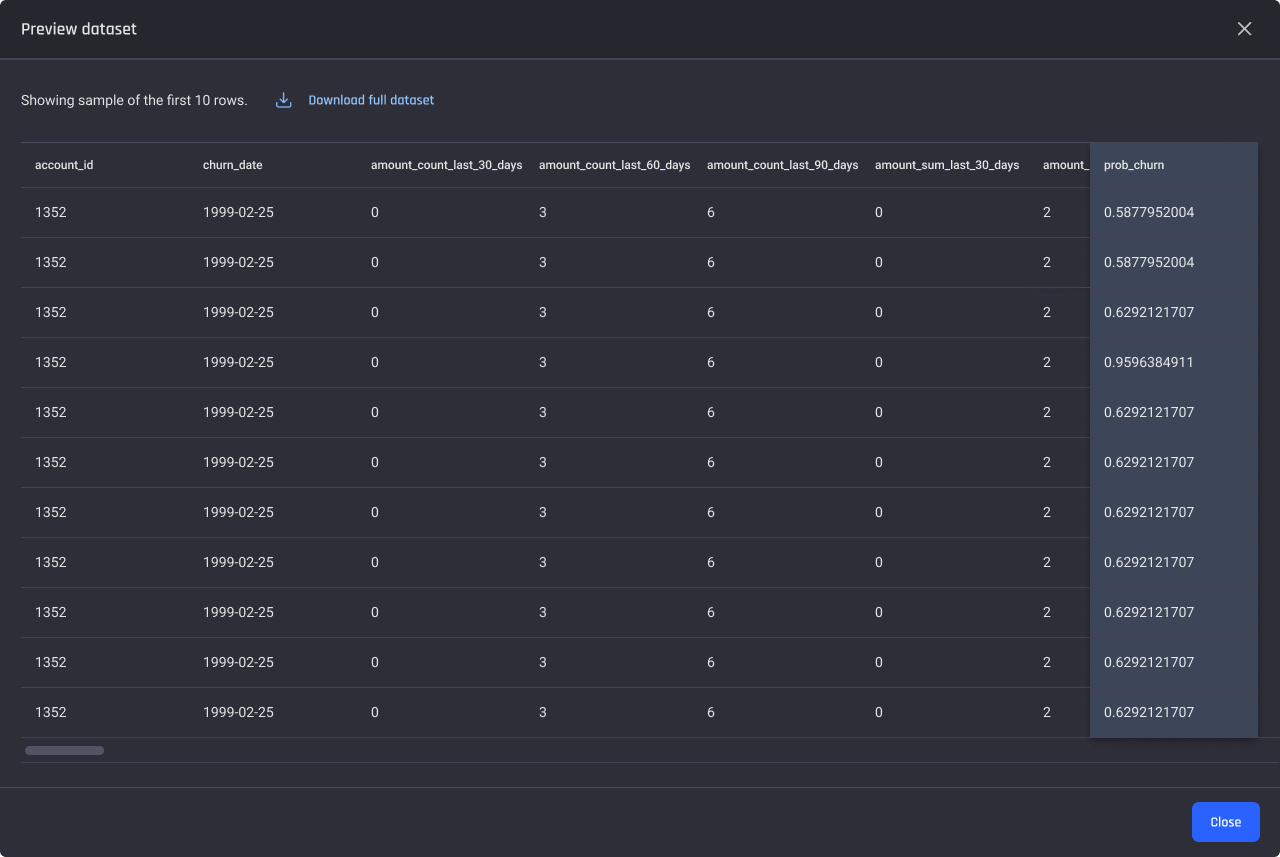

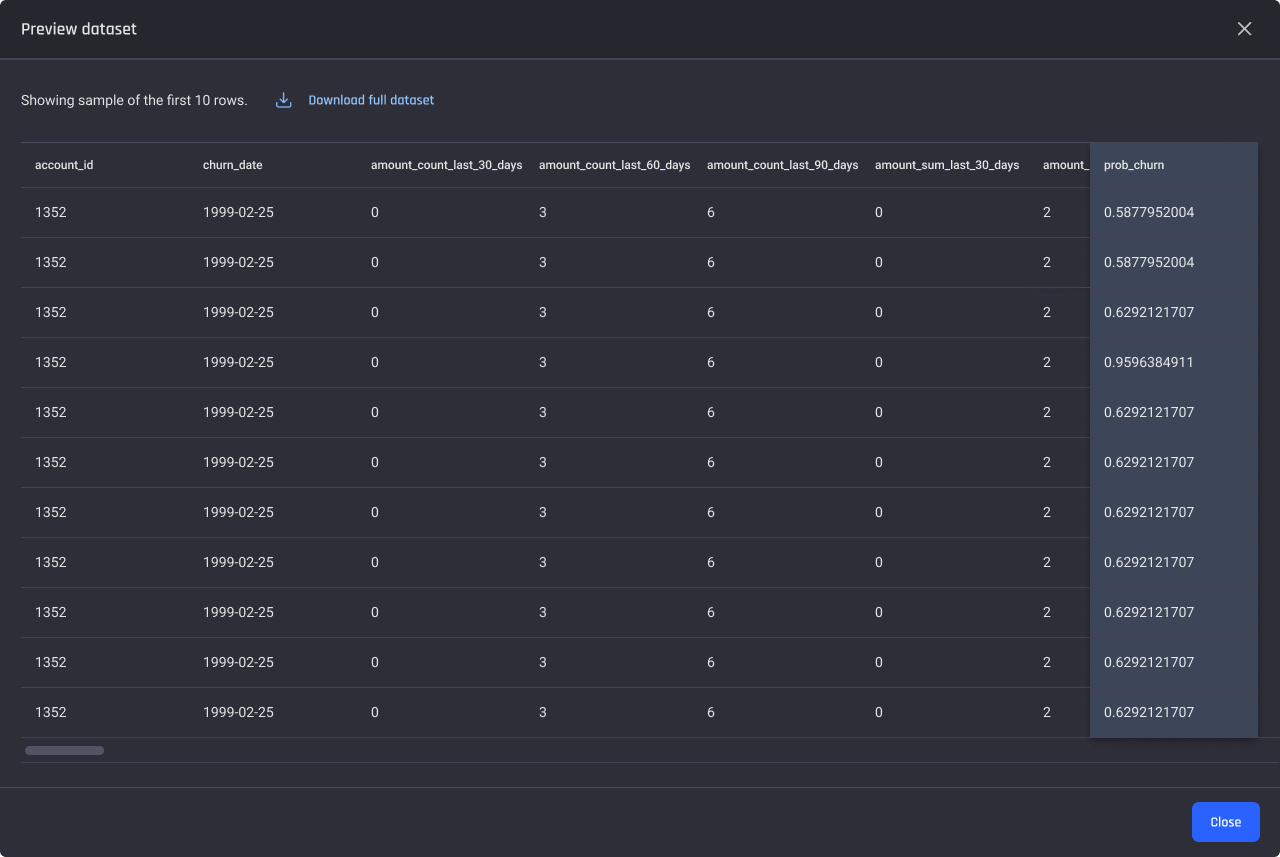

Get Churn Probabilities for Every Customer

The Engine delivers individual churn probabilities for every customer. Get actionable results that allow you to implement retention strategies according to your unique risk tolerance.

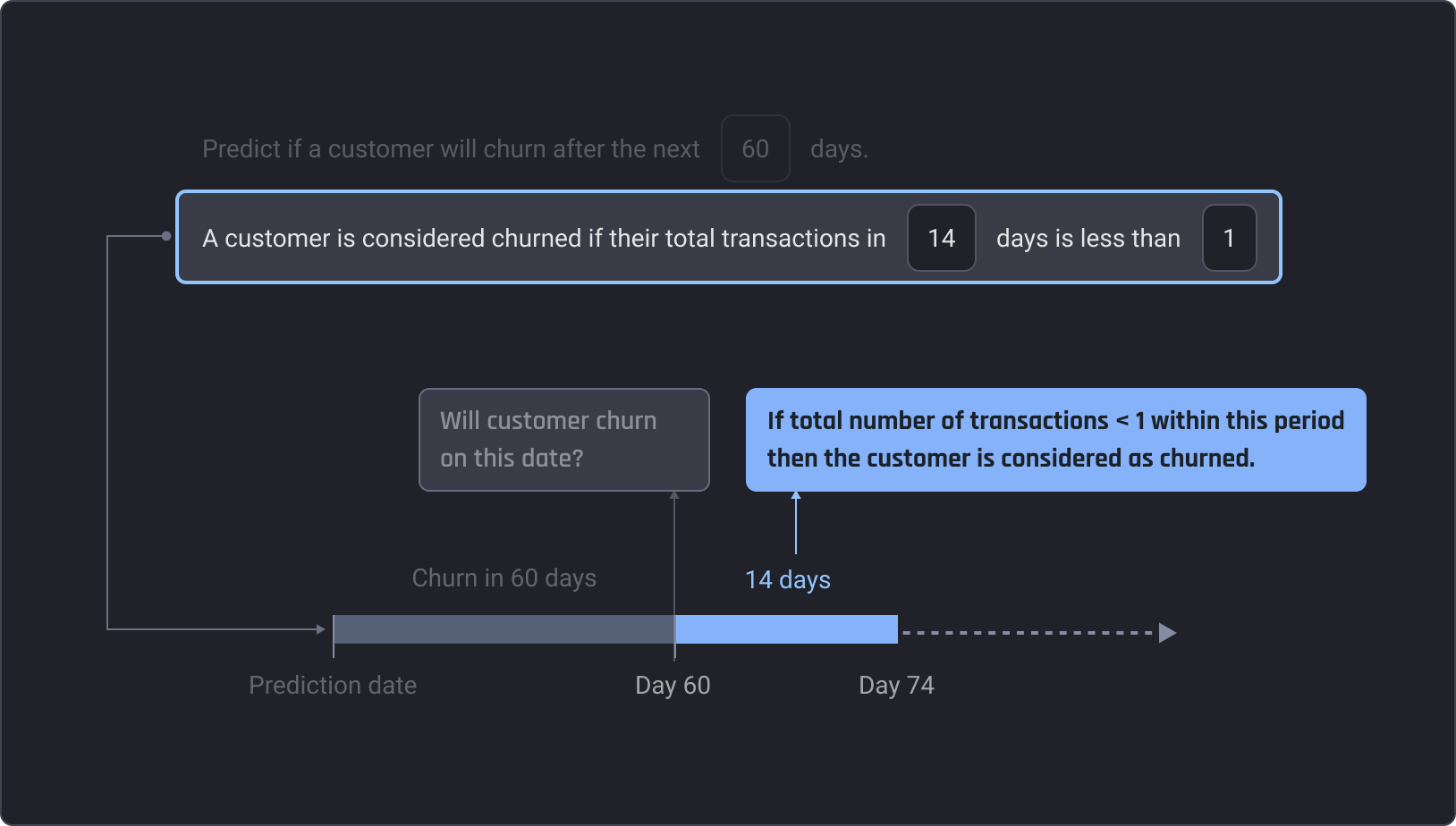

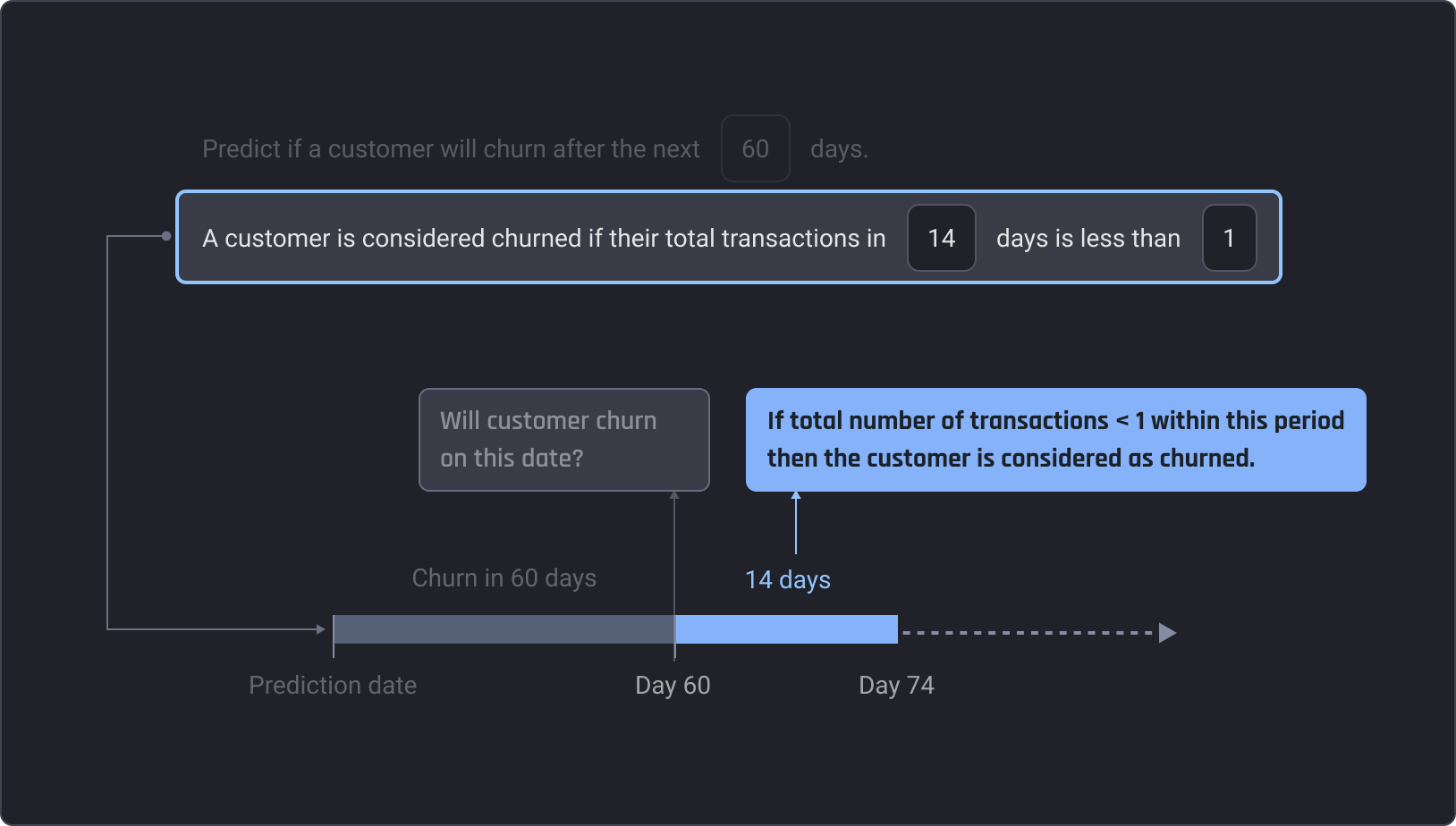

Flexible Churn Definition & Lead Time

Results Tailored to Your Businesses Needs

Businesses don't have a one size fit's all definition of churn. The Engine gives you flexibility to define churn conditions and lead time, to ensure the final results are tailored and meaningful to your business.

Automatically Generated Features

Assistance in Maximizing Prediction Quality

The Engine is the only churn prediction platform that automatically computes time-based purchasing statistics. These stats are generated over short, medium and long term rolling time frames to maximize prediction quality.

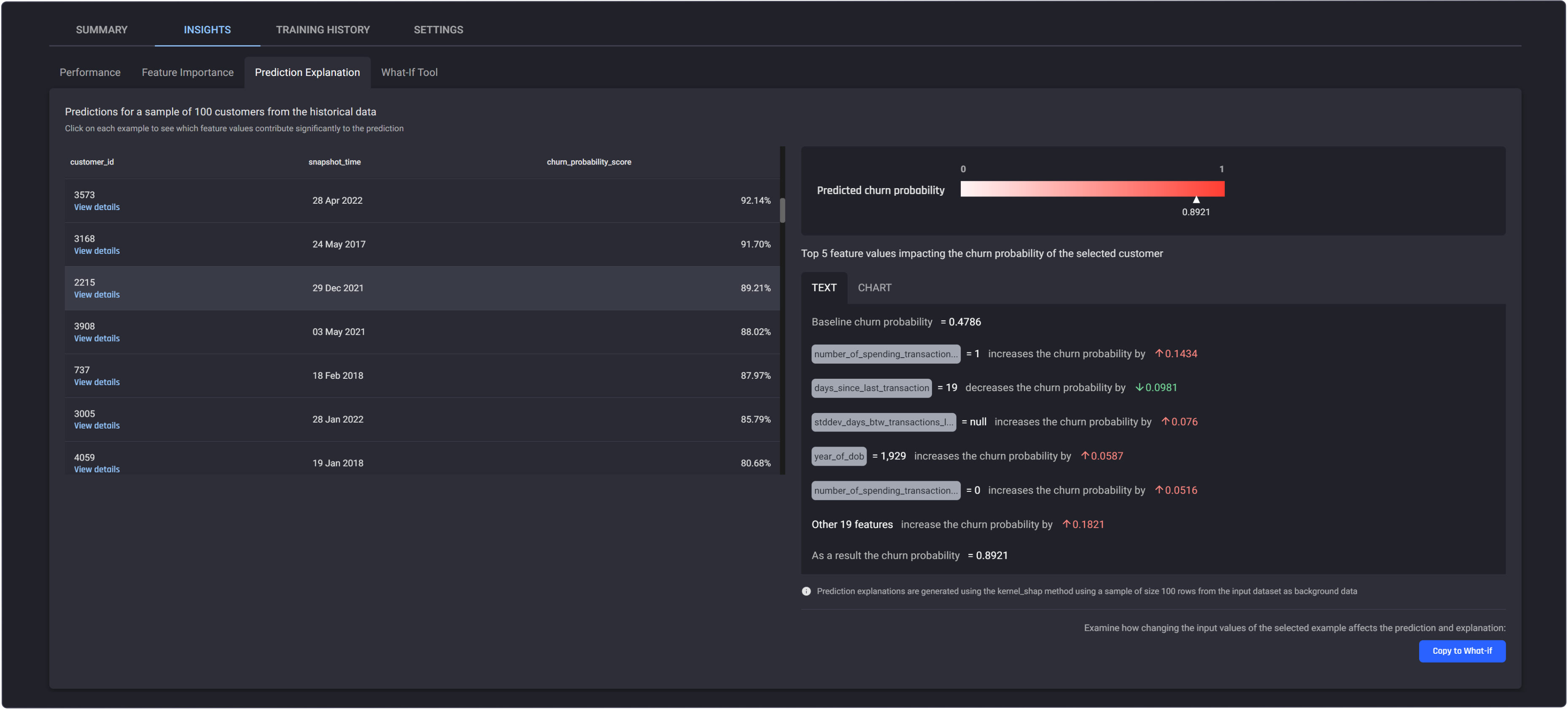

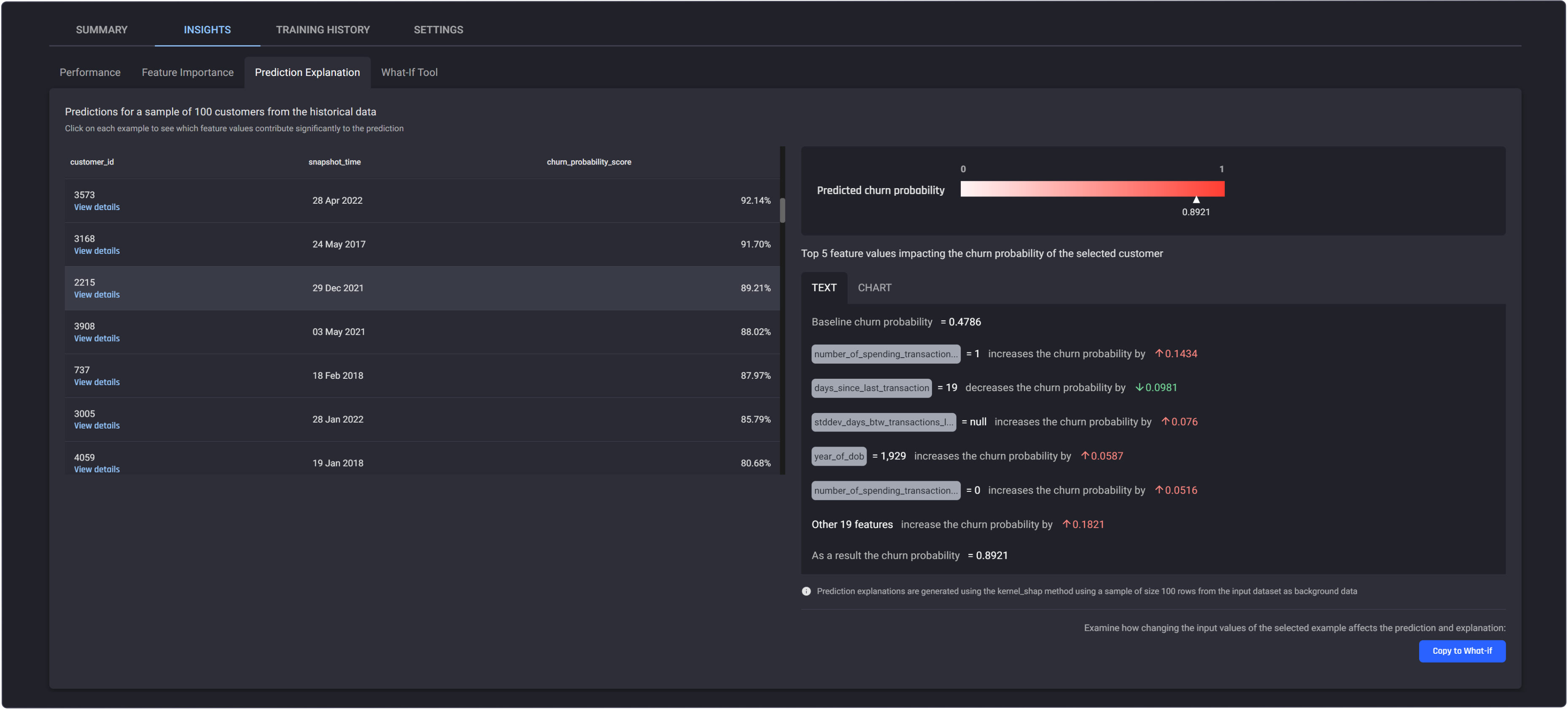

Explainable Predictions

Understand Why Each Customer is Predicted to Churn

The Engine’s Feature Importance and Prediction Explanation tools allow you to understand which features are impacting churn probability the most.

Get Churn Probabilities for Every Customer

The Engine delivers individual churn probabilities for every customer. Get actionable results that allow you to implement retention strategies according to your unique risk tolerance.

Results Tailored to Your Businesses Needs

Businesses don't have a one size fit's all definition of churn. The Engine gives you flexibility to define churn conditions and lead time, to ensure the final results are tailored and meaningful to your business.

Assistance in Maximizing Prediction Quality

The Engine is the only churn prediction platform that automatically computes time-based purchasing statistics. These stats are generated over short, medium and long term rolling time frames to maximize prediction quality.

Understand Why Each Customer is Predicted to Churn

The Engine’s Feature Importance and Prediction Explanation tools allow you to understand which features are impacting churn probability the most.

Individual Churn Predictions

Get Churn Probabilities for Every Customer

Get Churn Probabilities for Every Customer

The Engine delivers individual churn probabilities for every customer. Get actionable results that allow you to implement retention strategies according to your unique risk tolerance.

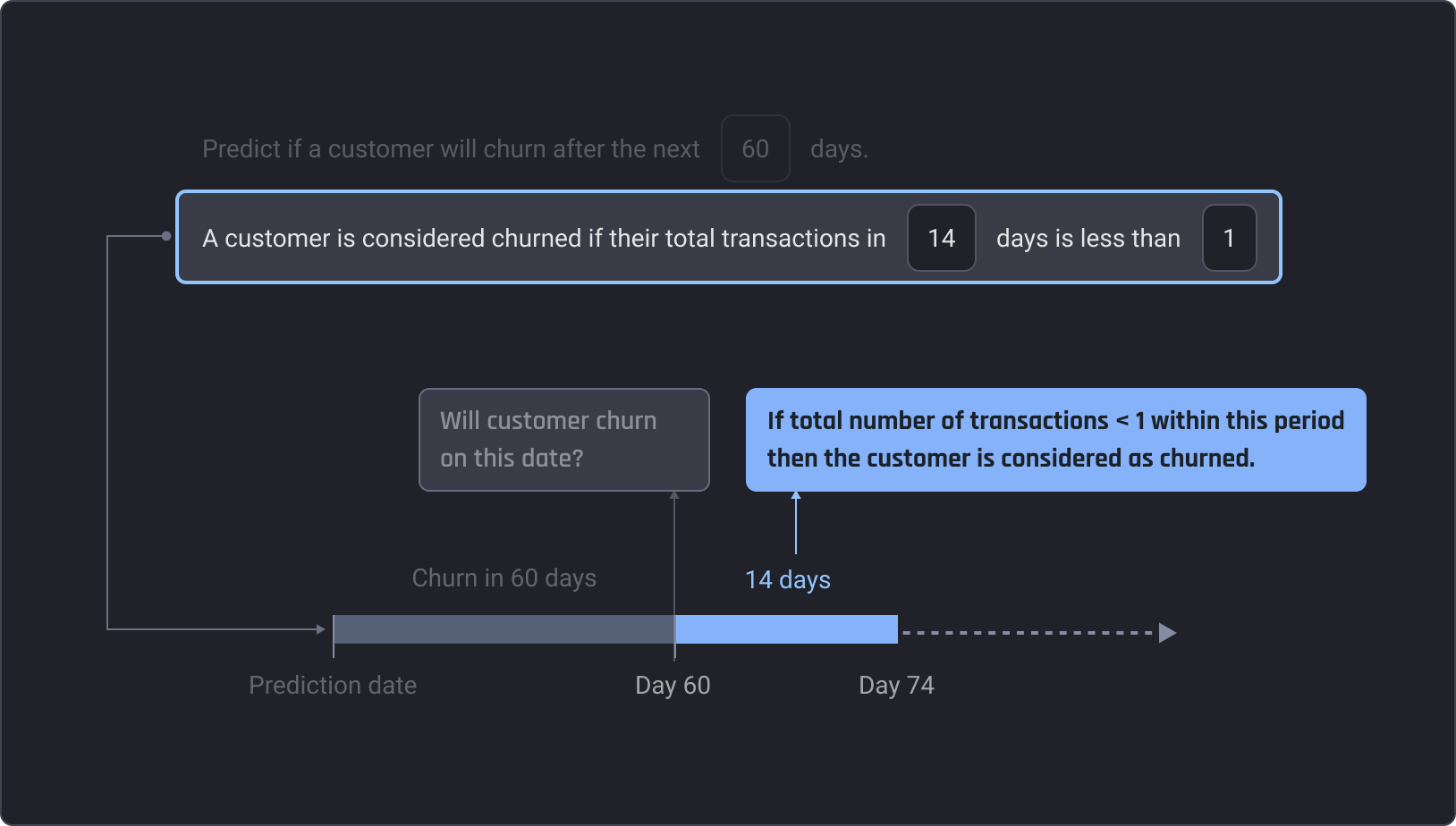

ADJUSTABLE CHURN DEFINITION AND LEAD TIME

Results Tailored to Your Business Needs

Results Tailored to Your Business Needs

Businesses don't have a one size fit's all definition of churn. The Engine gives you flexibility to define churn conditions and lead time, to ensure the final results are tailored and meaningful to your business.

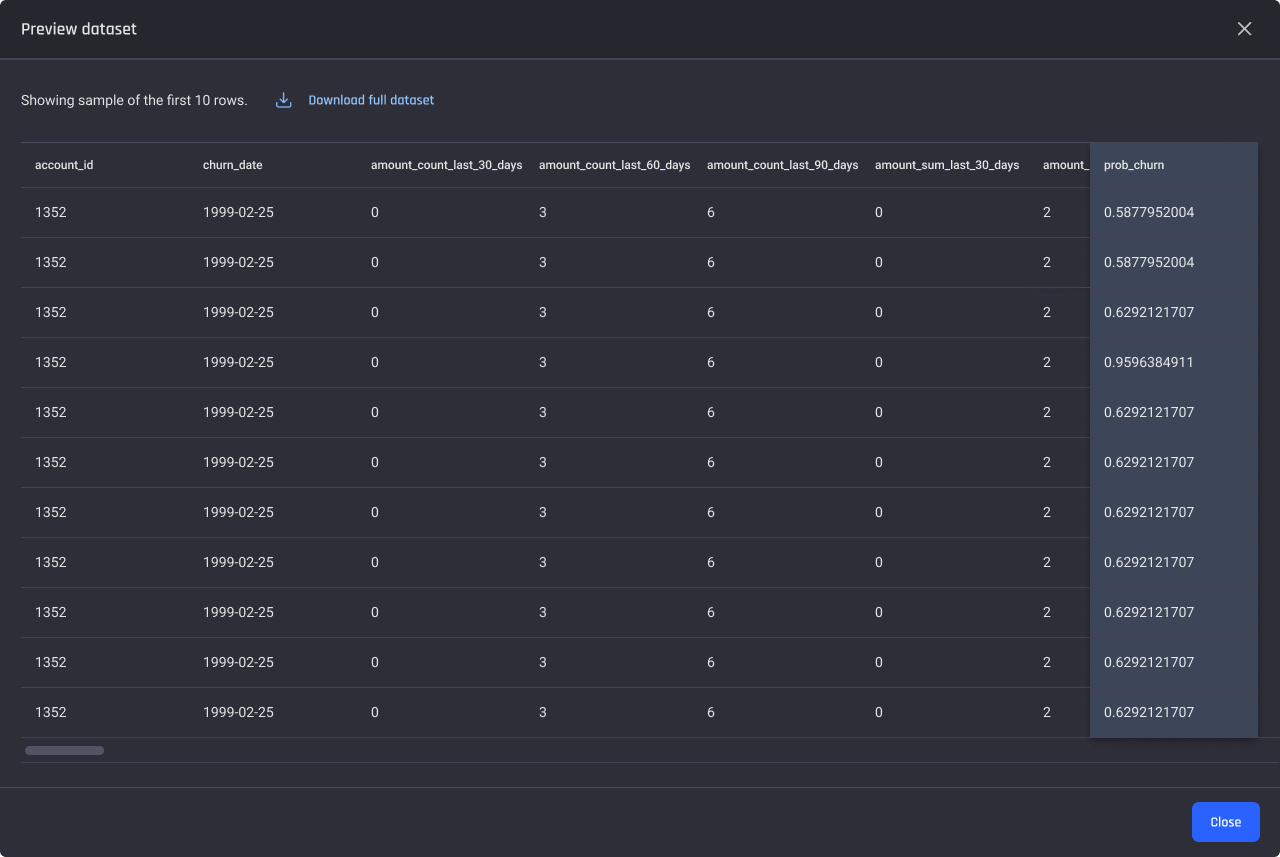

AUTOMATICALLY GENERATED FEATURES

Assistance in Maximizing Prediction Quality

Assistance in Maximizing Prediction Quality

The Engine is the only churn prediction platform that automatically computes time-based purchasing statistics. These stats are generated over several rolling time frames to maximize prediction quality.

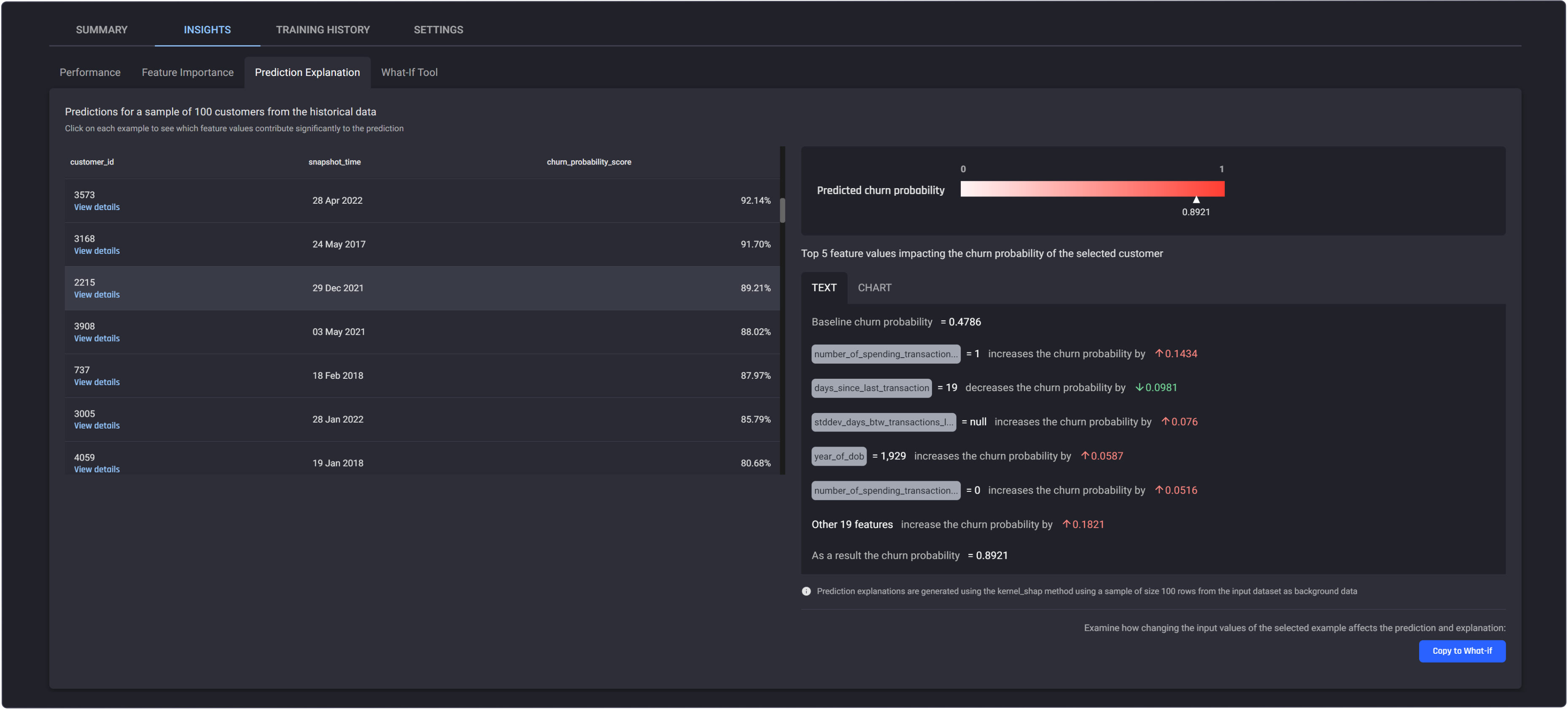

EXPLAINABLE PREDICTIONS

Understand Why Each Customer is Predicted to Churn

Understand Why Each Customer is Predicted to Churn

The Engine’s Feature Importance and Prediction Explanation tools allow you to understand which features are impacting churn probability the most.

Book a Demo

Book a Demo

Have a call with us to discuss your need and determine if the Engine is right for you

Solution Workshop

Solution Workshop

Together, we’ll help you to define your use case and determine the value it will deliver

Data Review

Data Review

Our team will gauge your data and technical infrastructure to support your implementation