This article details the options that are available to define churn within the transactional option in the customer churn prediction template.

Defining churn for the transactional option in the customer churn prediction template

The Customer Churn Prediction template automates the entire process of creating an end-to-end solution to predict which active customers are likely to churn in the near future.

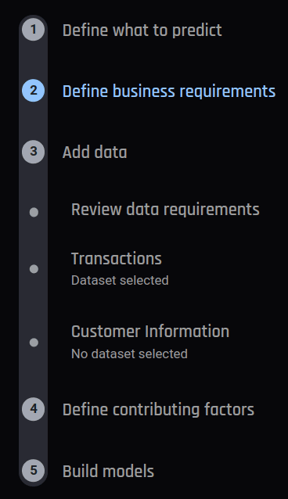

When creating a template app, users have the ability to establish the churn definition in step 2, "Define business requirements", which allows for specifying the customer behaviors that will be classified as churn.

Users can define churn in step 2 of the app builder

Users can define churn in step 2 of the app builder

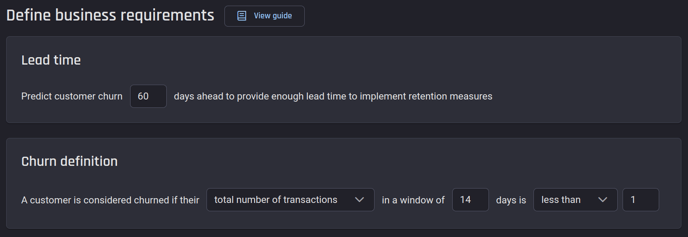

Users can define it to suit the objectives of their transaction-based business, by providing suitable values of four parameters:

-

Lead time: The timeframe within which the business should be aware of a customer's intention to churn. This is typically the time required for the business to implement preventive measures against churn

-

The measure of activity (e.g. number of transactions or total transaction amount) used to determine churn

-

The period over which the customer's activity is measured to identify churn

-

The threshold value of the measure of activity to determine churn

The four key components of the churn definition

The four key components of the churn definition

💡An example illustrating the significance of the two time periods among the parameters can be found in the Appendix below.

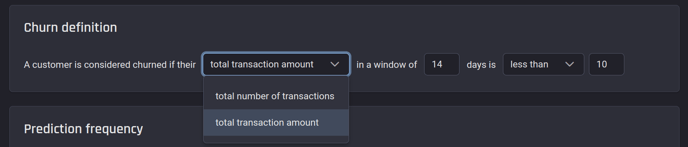

By default, the “total number of transactions” is used to determine whether a customer will churn or not. If the number of transactions is fewer than a certain threshold (e.g., one transaction), they are considered churned.

Another way of defining churn is through the “total transaction amount”. In the illustration below, a customer will be considered churned if they have less than 10 (currency/unit) total transaction amount in a 14-day period:

After clarifying the churn definition, the next step is to define the contributing factors. For more information, read What do "contributing factors" mean in the customer churn prediction template?.

Appendix: The churn definition

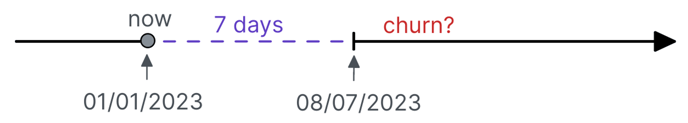

Customer churn prediction helps businesses increase their retention rate by providing early warnings of customers with a high risk of churn. With this information, businesses can proceed to implement customer retention strategies to reduce the likelihood of churn. However, if the time of the warning is too close (for example, the next day), there will not be sufficient time to implement any retention strategies. Therefore, an appropriate interval should be added after the prediction time in the churn definition, for both the transactional and subscription options.

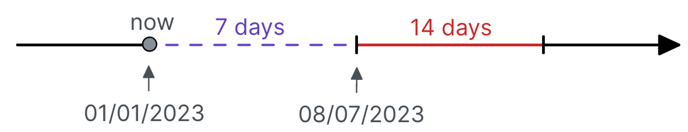

For example, on 01/01/2023, one wants to predict which of their customers will churn in the near future, and they need 7 days to respond. The situation can be described with the illustration image below:

In the period after 08/07/2023, assuming that the following rule is set under the transactional option: if a customer has no activity in a 14-day period, they will be considered as churned. Based on this rule, the machine learning models will predict the customers' activity in the 14-day period (the red period in the illustration below), and determine the churn status.

The trained model estimates the likelihood (for every active customer) that there will be no transactions in the 14 days period following the 7 days period

The trained model estimates the likelihood (for every active customer) that there will be no transactions in the 14 days period following the 7 days period