Providing a Trade Company with a competitive edge through timely insight into regional trade flows, for better trading decision-making.

The exponential increase in the amount of data needed in real-time trade decision-making impels goods traders to re-evaluate their traditional models.

PI.EXCHANGE’s AI & Analytics Engine predicted the regional trade flow of competitors in tactically useful time horizons. This timely insight into trade flows represented a view of market fluctuations created by supply and demand and supported a tactical increase or decrease in goods and pricing.

Partnering with the platform, enabled business intelligence gathering in an efficient, accurate, and repeatable manner, ultimately allowing for a greater information edge over the competition to make enhanced tactical trade decisions.

Trading Industry Challenge: How to leverage growing amounts of data?

With an increasing amount of data collected at an increasing pace, traders are trying to leverage their owned data assets to inform their real-time decision-making and remain competitive in a highly competitive industry. Add to that, there is a significant amount of data publicly available. This presents a unique opportunity for trade and logistics companies to find and develop new methods to uncover accurate and timely insights for a competitive advantage.

Existing insight extraction methods

Currently, the methods used by the trade industry to extract insights from data are resource heavy, slow and, require highly specialized staff. These methods are at odds with the global trend toward lean processes to increase efficiency and eliminate waste.

Whilst the value of data is universally agreed upon the manual and error-prone methods of extracting insights erode the available lead-time and accuracy needed to transform these insights into strategic decisions and actionable tactics for traders.

PI.EXCHANGE provides a resource-efficient easy to manage end-to-end AI & Analytics solution for traders looking to capitalize on information to enhance trade decisions.

Gross commodity trading margins have dropped 20% since their peak in 2015 amid fierce competition and more widely available market intelligence. Predictive analytics provides traders with the opportunity to regain their information edge. However, the industry’s digital maturity is one of the lowest as compared to other industries.

The AI & Analytics Engine Provided Actionable Business Intelligence

Data Wrangling Feature

The initial stage was to cleanse and enrich the company’s historical data using the data-wrangling feature and to provide only the relevant attributes needed for the platform to recommend the optimal model for the best possible prediction.

Model Recommendation & Selection

Machine learning was subsequently used to recommend models to best predict the destination regions given the data attributes. From the recommended models, the selected models are trained and evaluated using the AI & Analytics Engine to recommend the best model based on criteria like predictive performance, time

cost etc.

Deploying the Model

The best model was then deployed to perform the prediction against new data on the destination region. This resulted in increased accuracy of predictions, the flexibility of deployment was offered with deployment performed on the cloud or to an on-premise server.

Consuming Prediction Outputs

Once deployed, the model's corresponding prediction API endpoint is available immediately for use. To enable all specializations and cross-departmental consumption, access to the predictions via an Excel plugin and web apps was available

End-to-end Life-cycle Management

The model life-cycle management feature enabled the client to manage the performance of the model over time from the platform, this was automatic and continuous, providing real-time view of model health.

Results and Benefits

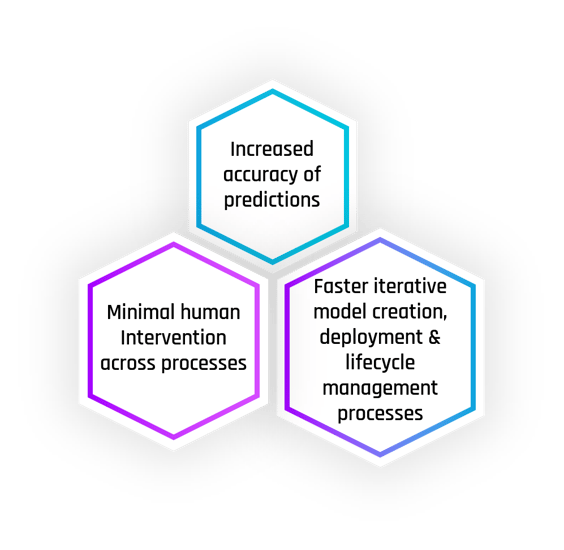

The model with 7 times the accuracy of a human could predict competitors' destination region.

The process within a streamlined pipeline required minimal human intervention. The speed at which the data set was cleaned, the model recommended and deployed and the insights accessed were significantly faster than their current process.

The trading company via the platform now had timely actionable business insight gained with minimal resource allocation. Allowing for;

- Optimal purchase, sales timing, and locations.

- Optimal inventory positions.